Tangents from a few books about money. I heartily recommend the one by Harry Browne; the rest are OK.

,

Fail Safe Investing, Lifelong Financial Security in 30 minutes, Harry Browne, 1999

If you’re a wimp (like me) this is the best book on investing. And if you get interested in Risk Parity style portfolios, check out Frank Vasquez’s “Risk Parity Radio” for up to date opinions and advice on this style of portfolio construction.

- If you want to speculate, look elsewhere. Harry Browne advises that your profession will be your primary source of wealth and warns against taking risks like investing on margin.

- Clean, clear advice. Some specifics are outdated (such as how to purchase investments) but his conservative concepts are solid.

- I plan on revisiting this book every year. I’ve taken a more aggressive approach than his “Permanent Portfolio” (more stocks, less gold and bonds). Still, I thank him for introducing me to Gold. It’s a controversial asset but a game changer for me. It added a third uncorrelated asset class to ballast the portfolio, which made me more comfortable with investing heavier in stocks.

,

Explore TIPS, Harry Sit, 2010

Gotta start somewhere and I was curious about Treasury Inflation-Protected Securities when I started my investment journey in 2022. I’ve gone with a different investing strategy.

- TIPS are bonds with inflation insurance. Harry is a fan of going heavy on TIPS relative to nominal bonds. (I believe a properly diversified portfolio will compensate for inflation with the other asset classes, so I don’t like the extra cost of the inflation insurance).

- Purchase them at auction, the secondary market or via ETF’s. Harry Sit is open to all investment avenues.

- I-bonds are more like CD’s since they can’t be sold on the secondary market. Harry Sit is not a fan.

,

Value Averaging, The Safe and Easy Strategy for Higher Investment Returns, Michael E. Edleson, 1993

An optimized way to pour cash into the investment market.

- “Value Averaging” is setting a goal for how much you want an investment to increase over time and purchasing accordingly. Unlike “Dollar Cost Averaging”, Value Averaging pushes you to buy more when the markets are down and less when they’re up.

- If you want to be awesome, the book gives a bunch of math to optimize the investment curve.

- As a retail investor playing with small sums, I believe optimization is a waste. After learning the basics, the smallest edge requires a ton of study. Any such such bet will be overwhelmed by the capricious whims of the gods. Better to enjoy the finer parts of life.

,

Die Broke, Stephen M. Pollen and Mark Levine, 1997

I found the book in a random giveaway pile in Berkeley, maybe in lower Sproul Plaza. Two cities (and decades) later, I finally read it.

- Great title and interesting provocation to reevaluate our relationship to money, work, and retirement.

- I love books with unique structures. Part 1 is a short self help mindset manual. Part 2 is an alphabetical list of chapters with practical advice. (Since this book is almost thirty years old, I lightly skimmed the second part since I presume most of it is out of date.)

- I enjoyed Part 1, partly because I already agree with their four key maxims. I view employment as a transaction not fulfillment, believe in avoiding debt, and doubt the positive good of leaving a large bequest. I’m not totally sold on the maxim of “Don’t Retire” but I appreciate their skepticism of the modern retirement paradigm.

,

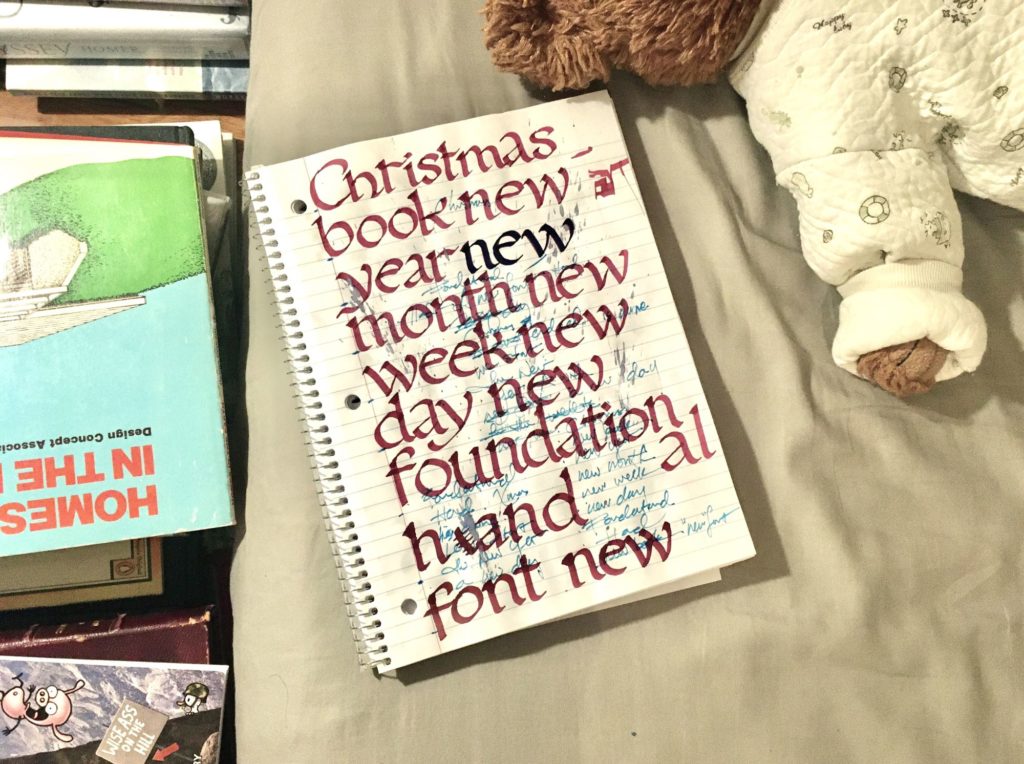

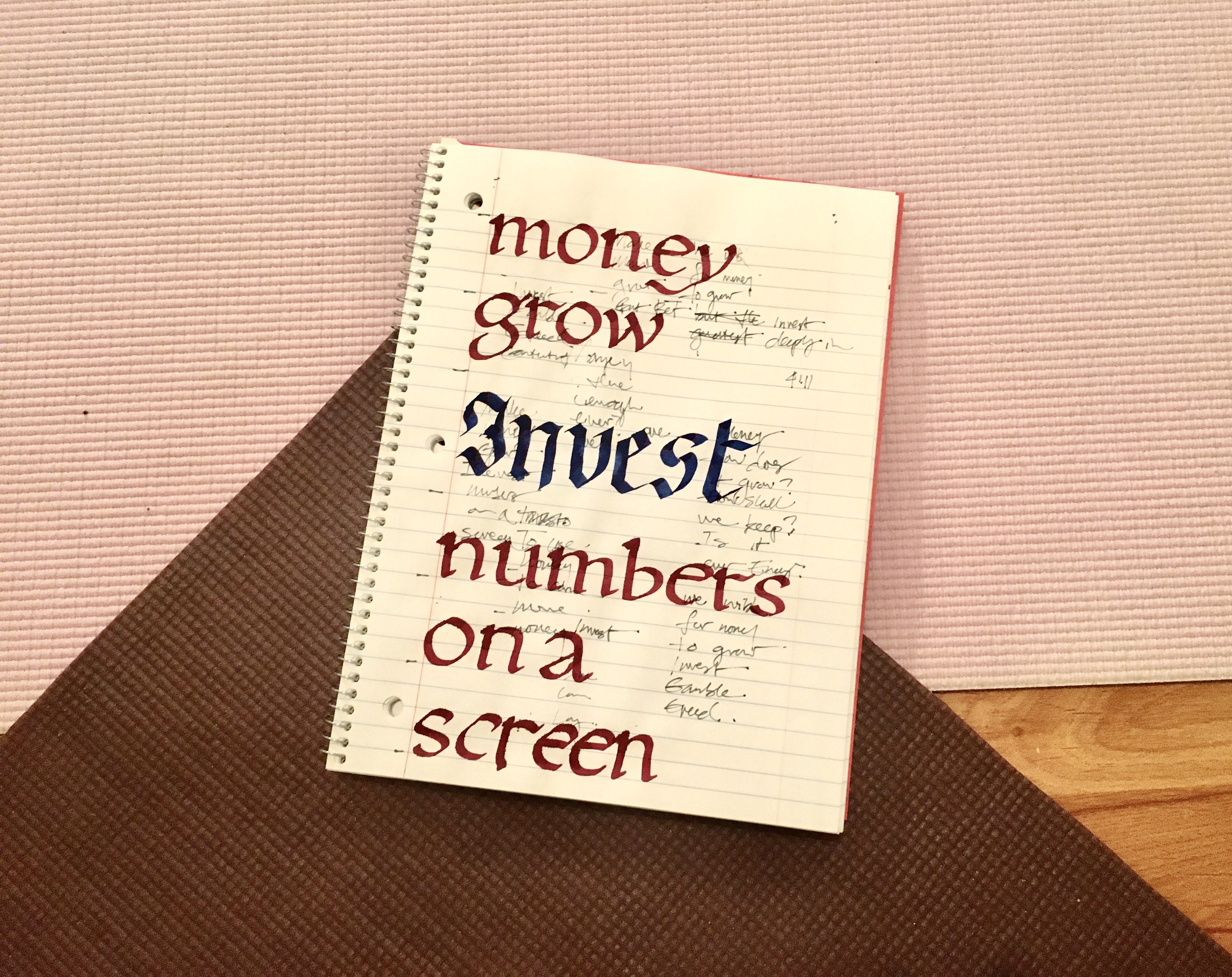

make

money

grow

invest

digits

on a

screen

.